- Introduction

There is no clear legal definition so far for the concept of Public Private Partnership (PPP). In the present context, the governments (Developed and Undeveloped) are facing numerous limitations in fulfilling their complicated financial requirements. Due to inadequacy of Government and foreign funds particularly, for providing economic Infrastructure, it is compelled to look for private sector participation for financing. Since the private sector is always looking for the profitable ventures, they are much reluctant to invest in the services which are not profitable. (Eg. water supply and sanitation) In this context, PPP is an approach that used for attracting private capital strategically for identified sectors/sub sectors where the “risk factor” is crucial with regard to return to investment.

- Definitions for PPP

PPPs are defined by various agencies in different manner and there is no universally accepted definition for it. Some definitions of PPP are given below.

- PPP means an arrangement between Government or statutory entity or Government owned entity on one side and private sector entity on the other, for the provision of public assets and/or related services for public benefit, through investments being made by and/or management undertaken by the private sector entity for a specified period of time, where there is a substantial risk sharing with the private sector and the private sector receives performance linked payments that conform to specified pre-determined and measurable performance standards.

(Department of Economic Affairs, Ministry of Finance, India)

- PPP is a generic term for the relationships formed between the private sector and public bodies often with the aim of introducing private sector resources and/or expertise in order to help provide and deliver public sector assets and services. The term PPP is used to design, build, finance and operate (DBFO) type service contracts and formal joint venture companies/

(Local Government Procurement Agency, UK)

- A PPP is a partnership between the public sector and private sector for the purpose of delivering a project or a service traditionally provided by the public sector. PPPs come in a variety of different forms, but at the heart of every successful project is the concept that better value for money may be achieved through the exploitation of private sector competencies and the allocation of risk to the party best able to manage it.

(Department of Environment and Local Government, Ireland) After going through the different definitions of on PPP, one can simply say that PPPs are long-term contractual arrangements between the public and private sectors for the delivery of public services in efficient manner. In this scenario, PPPs involve three main features namely risk transfer, long-term contracts and partnership agreement. The governments around the world tend to adopt this approach owing to three main types of benefits.

- Ability of developing new infrastructure services despite short-term fiscal constraints.

- Value for money through efficiencies in procurement, construction and operation.

- Improved service quality and innovation through use of private sector expertise and performance incentives.

- Difference between private partnership and privatization

Public Private Partnership (PPP) and privatization are completely two distinct modes. The privatization is a transfer of an ownership of public assets permanently to a private sector. This transfer is also done under different methods. However, under the PPP, the government is constantly liable to perform certain tasks while the intervention of the private sector is obtained in different modes. At the same time, government has a responsibility in supplying the relevant service by having a direct contractual agreements between government and the service provider. But in the privatization, responsibility of providing the relevant service is assigned to the private sector. Nevertheless, in the country like Malysia where the privatization is widely implemented, there seem to be obtaining certain contribution from the private sector in investments under the PPP approach. These principles have been clearly spelt out in the 9th Development Plan of Malaysia. In the final analysis it is imperative to understand that PPP is not a synonym to privatization and privatization or divestiture denotes buying an equity state of a state-owned enterprise by a private entity.

- Different Public Private Partnership approaches

Different modes of PPP approaches are operational at present and based on the mode of operation, they it can be categorized into four types.

i Management Contracts Entering into an agreement by a government with the private sector relating to supply of certain service either on short term or long term basis on a limited terms is described as Management Contracts. Mostly, the private sector participation is obtained through this method to get the services like rural roads, drinking water supply, and sanitation etc. Under this method, the government institutions undertake their responsibility in providing the relevant service by continuously investing in the same and the private sector gets involved by way of a short term or long term contractual agreements only for the implementation of providing and maintaining such services.

ii Provision of infrastructure facilities through small scale private suppliers. It is not compulsory to deal with large scale private sector in PPP’s. Many developing countries are presently implementing projects for providing public utilities or services through small or middle scale entrepreneurs. The projects like small scale power plants and drinking water supply schemes implemented by middle or small scale entrepreneurs are the good examples. This is not a privatization and is more or less similar to management contracts. Providing these types of services should be carried out under the government rules and regulations as those services are purchased by the government. (Example; purchasing of electricity from the small power plants at an agreed unit price) The distribution of such cervices is carried out through the government or private sector.

iii User fee Public Private Partnership Under this method, planning, implementation, financing and maintenance of certain infrastructural assets owned by the state agencies are assigned to a private party. This can be used for upgrading or widening of such assets. Under this process, certain project or an asset is assigned to a private party for a specific period ie, 25 or 30 years under a concessionary agreement and after the expiry of given period, it is vested back with the government. This type of methods is carried out under the BOT (Built, Operate and Transfer) or DBFO (Design, Built and Finance) approaches. During a given period, the capital cost connected to the project or asset, maintenance cost and profits are recovered through user fees. Collection of toll from Highways can be given as a good example. Two major issues to be faced with this type of partnership approach are the risk of having a good demand and affordability of the users. Since the investors are more concerned about these two factors, the government should provide cost subsidy byway sharing a part of service charge or purchasing of such services as a practical remedy. However, it is important that the government should monitor or regulate those aspects to ensure that quality of the service, price and service conditions are favorable to end users. In many countries, the express ways, railway service, urban transport, port activities, airport services, power supply, drinking water supply in urban areas and communication services etc. are carried out through Public-Private Partnership approach (BOO, BOT and DBFO)

iv Public private partnership based on readymade service (availability based PPP) Under this method also, the production of a service or its responsibility is assigned to a private party by the government based on the existing on rules and regulations. Accordingly, planning, investment, building re-building and management and maintenance are assigned to a private company or an investor and the services are purchased by the government. After purchasing of such service, it is distributed to the public by the respective government agency or through a private company. The purchasing of such service production from the private company is done by the government for a specific time period and the price agreed upon at the time of purchasing. Under this arrangement, the relevant company doesn’t have any risk connected to demand of its service or price. At the same time, the conditions related to supply of service and agreed price are included into the agreements reached at the beginning. If necessary, required legal provisions for termination of the agreement or renewal of the same is included into it. The best example for this type of partnership is the power purchase agreements. The power generated by the private power generation plants are purchased by the Ceylon Electricity Board and distributed to public through its national grid. The distribution of the power is also done through the private companies. Internationally experienced that the social infrastructural projects like schools, hospitals, jails etc. are also managed through this Public Private Partnerships (PPP) approach. Agreements are also reached with private sector for the provision of hostel facilities, supply of machineries and other service assistance connected to such projects. When a necessity has arisen to provide maximum service in an efficient manner while there is a shortage of capital investment, this approach is very important. The UK, Canada, Japan and South Korea have entered into such service agreements.

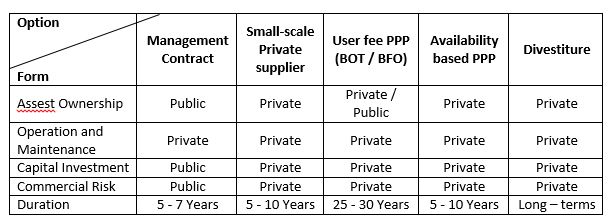

Roles and Responsibilities of Public and Private Entities under different forms of Private Sector Participation

05 Background for successful public private partnership

Practically it has been proved that the provision of socio economic services efficiently for the citizens of a country could be done through the Public Private Partnership. This would facilitate enormously achieving macro level objectives in any country, namely increase in economic growth, acceleration of development and reduction of poverty etc. Developed countries are mostly adopting this approach in improving their socio economic infrastructure and presently the developing countries have also paid much attention in this regard. However, when doing so, it is important to have common dialog and positive views and attitudes in order to achieve the objectives through this approach. In other words, government should reserve the rights of encouraging the requirement of improving the service provided the public and widening the same and also requirement of securing ‘value for money”. At the same time private sector should receive a reasonable profit margin for their investment while preparing to render a great contribution to the public, based on their social responsibility. Some of the basic conditions that are required to ensure the provision of efficient service network for accelerated economic development through the PPP are given below.

- The PPP approach should be clearly indicated in the government policy framework and there should be a commitment to do so. Specially, the private sector is coming forward to bear risk for their investment, only if such provisions one available in the government policy. The following principles should be clearly spelt out in the policy framework.

- Justification in principle, for applying PPP.

- The procurement procedures adopted in obtaining services from the private sector. (Transparency)

- The criteria adopted in selecting relevant projects and assets.

- Conflict resolution procedures.

- Monitoring procedure in obtaining services.

- The legal and regulatory framework should be openly exhibited and the legal background at every stage should be adequately described from the beginning of the project and up to the point of providing services. Especially the provisions available in the government institutions to enter into agreements with the private sector, possibility to charge price or tariff, actions to be taken when defaulting payments, and actions to be taken when defaulting the agreements etc should be clearly indicated. The private sector and the lending institutions normally expect the explanations which are described below.

- Whether the unsolicited projects are approved and if so, the procedures adopted?

- The biding process is how far transparent?

- Whether the budgetary provisions are adequately available for the payments for government involved projects?

- Whether the government institutions have the legal authority or entrusted such provisions for entering into with agreements.

- Whether the legal provisions and institutions are available for the relevant project or the asset owning sector for regulating its activities.

- Whether adequate staff with knowledgeable professionals is available in the regulatory institutions.

- Whether it is clearly stated the price or tax enforced on the end user

- Whether there are legal or special regulations available connected to investor’s decision and accounts

- Any specific details with regard to undertaking of responsibility in the event any rules and regulations are changed or amended

- Actions to be taken in connection with institutional conflicts, strikes and remedial measures on loses, if incurred

- Under these circumstances, amendment of the existing rules and regulations or enactments is required to encourage to motivate private sector to take investment decisions. (iii) In order to win the investor confidence, it is important to indicate the proposals expected to be implemented on a priority basis through public-private partnership in the government’s short-term and long-term development/ investment framework. By doing so, the commitment made by the political authorities and the government’s investment policy could be clearly made available to convince the investors and donor agencies. In the investment framework it should not be only listing of such investment proposals and there should be a profile of detailing out the task to be performed by the both parties and the required sectors of investments and its quantum and location etc. When requesting offers from the reputed investor companies such investment plans would be much useful. It should also be a clear certification for the private sector to show the transparency and good governance.

- In addition to providing legal and regulatory guidelines connected to PPP, it is important to have a implementation framework. A separate special unit in this connection should be setup in the central government (PPP, Unit) and if necessary, such units may also be setup at provincial level. These units should prepare implementation plans and undertake the implementation based on a time frame. In this regard, these units must have professionals with expertise knowledge who have to be ready with the required procurement and monitoring procedures. This is very important in attracting reputed foreign companies. In this PPP investment process, there are many steps to be followed in preparation of policies and strategies, identification of projects, evaluation of projects, selection of suitable investors, management and monitoring etc and these steps could be successfully completed through proper coordination from central level up to provincial level.

- International Experiences

Experiences of some selected countries in the adoption of PPP approach are explained briefly in this section. It is noted that the forms of PPPs differ from country to country to and sector to sector depending on the circumstances that they confront and political and administrative structures that they adopt.

- Bangaladesh

The Government of Bungaladesh has given priority for adopting PPP approach in key infrastructure sectors and policies and guidelines have been developed securing the rights of the public and private agencies and institutions with regard to investments that they are expected to make. The Private Infrastructure Committee (PICOM) which comes under the purview of Prime Minister’s office is mainly responsible for co-co-ordinating the PPP projects with the relevant agencies. The Ministry of Finance in Bangaladesh has taken some measures to support PPP initiatives and they mainly include.

- Reform of guidelines and institutional framework.

- Establish a separate unit of PPP for budget formulation and implementation.

- Make budgetary allocations annually for implementation of PPP projects.

- Introduce tax incentives for PPP investors.

- Increase publicity for the new PPP projects.

PPP investors are invited to embark on joint ventures in the areas of power, sea port, airport, telecommunication, energy and bridges. These investors are facilitated by the special agencies established under the public domain namely Infrastructure Development Company Ltd. and Infrastructure Investment Felicitation Centre. Their services mainly include providing finances and financial intermediation services, formulating project proposals, giving technical assistance and appraisal of project proposals.

- India

India has accepted the policy of obtaining private capital through PPP arrangements particularly, for infrastructure development projects at both national and regional level. Being a geographically large and federal state, all states provinces have developed their own policies and strategies to attract foreign investments by way of PPPs with a view to filling the investment gaps resulted from low savings in state economies. At national level, the Government has set up a “Viability Gap Fund” (VGF) with a view to ensuring enhanced access to PPP in infrastructure development by subsidizing the capital cost of access. Hence, the objective of the VGF is to meet the funding gap required to make economically essential projects that are commercially viable. The VGF has been operating since 2006 and to date 15 projects have been given approval for implementation. Karnataka State has taken measures to implement an Urban Water Supply Improvement Project through “Management Contract” which is one of the PPP models. While ownership of the existing and rehabilitated assests is kept with the relevant Urban Local Body, the responsibility of management has been contracted out to a private company for a period of three years. The private operator has been entrusted with the responsibilities of providing service connections, supplying treated water, ensuring reduction of distribution losses and collecting revenue through water bills. As per the commercial agreement, the private operator is eligible for receiving fees (60% of the fixed component and 40% of the variable component) based on fulfilling the performance targets. Further, additional sums are provided for the achievement of targets beyond a set level. In case, there is a violation of the conditions spelt out in the agreement, the contract is liable to be terminated.

- The United States of America

The highly developed counties like USA adopts PPP approach even in the management of service delivery institutions in social infrastructure sector namely hospitals, schools and universities etc. For example, operation of a state hospital is done using the Least Contract method under PPP, in the State of Columbia. The ownership of the assests of the hospital is with the State of Oklahoma and Columbia and the Columbia Health Care Corporation acts as the private partner or operator of the hospital. On fee basis, the hospital is run by the private partner and the state government received up-front payment (US $ 40 mn.) subject to paying annual rent amounts to US $ 9 mn. The key objective of the project is to improve the efficiency of operations and no transfer of ownership will be made. The private operator can run the hospital for a 50 year period on lease basis provided that no violations of the agreement be made.

- South Africa

South Africa is a country which has formulated a sound policy framework to attract PPP investors for making investments in infrastructure projects. The beginning of an integrated national PPP strategy came in 1997 with the establishment of an inter-departmental task team to develop policies and reforms to facilitate PPPs. Through establishment of the Municipal Infrastructure Investment Unit in 1998, municipalities have been given opportunities of obtaining technical and grant assistance for the promotion of PPPs. One of the important PPP concession project in South Africa was South Africa and Mozambique linking road of which total investment was around US $ 426 mn. This has been a new experience for the PPP approach, since it was difficult cross-border project. The government of South Africa was able to implement several toll road projects under PPP approach and they are functioning without failures due to well established legal and strategic framework coupled with the creation of a PPP unit in the Treasury. The other notable factor of success story is that political support and staff with highly qualified technical personalities.

- Sri Lankan experience in PPP’s

As stated in the Medium-Term Development Policy Framework (2011 – 2016) of the Government based on Mahinda Chinthana, the privatization of state owned business is not considered as a sole strategy of economic reform. (Page84) Nevertheless, in uplifting the management and the workmanship of the government owned business ventures, the government is paying attention to apply alternative strategies to get private sector involved. In this context, the government is paying its attention to the fact that the private sector has a social responsibility in addition to earning profits and as such, the private sector needs to be involved in implementation of government ventures and projects. As further described in the above Policy Framework, depending on Treasury funding for the government ventures should be under a minimum level and their capital base should be strengthened through different investment methods. The policy framework emphasizes PPP as a successful alternative funding method. At national level, strategic plan adopted for uplifting of infrastructure has gained considerable progress in PPP approach. For example, in the Colombo-South Harbour improvement project, the government has undertaken the work including construction of Brake-water (with foreign funding) while private sector has been allowed to do the work like construction of terminal. Also the government has initiated the construction of Second Coal Power Plant Project at Trincomalee with public sector involvement in transmission roots and a terminal for importing of coal. It is expected to obtain private investment for the power generation. Among the future projects where the PPP investment approach is expected to be widely used, the areas of Transport, Aviation, Milk and Dairy Farming, Tourism and Drinking water supply are mainly important. However, in Sri Lankan context, there is a common belief especially, at the regional level, almost all the projects which are financially feasible or not are to be implemented through government funding. The main reason for this is that after independence, all successive governments implemented “welfare state” concept, irrespective of their different political ideologies. Although, the country has gained many economic and social benefits under the “welfare state” concept, it is accepted the fact that it has created many unfavorable conditions in progressing the country as a middle income state. The main factor to be considered is that a considerable amount of government funds that would have been utilized for infrastructure development have been spent on social capital, rather than incurring them on selected targeted groups. This has resulted in slowdown the annual growth rate of the country comparatively at a lower level after the independence; (5%-6%) Although, a 30 year period has gone after introducing a neo-liberal economic policy, a considerable investment gap is prevailed due to lack of foreign and private investments to the county. When the Government tries to maintain investments at 7% of GDP, the private investment rate needs to be increased at 22% by year 2016 to maintain a high economic growth rate (about 10%). Presently, this rate is at about 16%. Under this situation, it is clearly revealed that the necessity of increasing private investments through alternative means of strategies. When looking at the South Asian countries like Malaysia and Thailand which have moved into the speediest development drive, private investments and PPP investments have increased tremendously. The main reason being the respective governments have created the required conducive environment for the same. Although, Sri Lanka is not maintaining hard privatization policy like these countries, it has become essential to create a conducive investor friendly environment, particularly at sub national level. Some of the actions that can be taken in this regard are as follows.

- Amendments to the existing enactments enabling to encourage the private investments. Particularly the Acts connected to institutions at national and provincial level needs to be amended taking into account the present day needs.

- Carrying out awareness programs for political leadership and officials (specially provincial and local). The alternative investment methods and the new plans and programs carried out by the foreign countries should be brought in to their attention.

- The attitude in the society that the private sector is always looking for earning profit (profit motive) while they are irresponsible in undertaking social responsibility. This needs to be eliminated and create a debate to show its positive contribution.

- Carrying out awareness programs among the business community regarding private sector contribution in the present context.

- An integrated approach should be adopted at provincial level with a view to creating a wide debate between the state sector and the private sector. The political leadership should take the lead role in this regard.

- Undertaking awareness programs for the general public regarding the capital market and its functions. In this regard, the stock market, role of the unit trusts and of broker companies, issuance of debentures and joint ventures should given due attention. Audio visual media and conferences can be widely used for this purpose.

- Procedures to be adopted at provincial level for promoting PPPs

The country like India where the federal system is in existence, the provinces have been entrusted with many powers and are having their own autonomy in making investment decisions. Nevertheless, Sri Lanka is functioning as a unitary state with provincial council system with a limited power of devolution. But even under this system there are opportunities in entering into PPPs and they can be used as a tool to face the problem of funding shortages. The Government of Sri Lanka has accepted the PPP investment approach as a policy and opportunities have been given to the provincial councils also to follow the same. In the Medium Term Development Policy Framework (2010-2016) published by the government, priority has been given for PPPs. Under the strategy worked out for attracting conducive environment it has been introduced desirable tax policies, and willingness to change the institutional framework. In the guidelines issued for the year 2012 to the provincial Chief Secretaries by the Finance commission, it is emphasized the requirement of implementing the projects though PPP basis by using limited development grants. In addition to obtaining the private sector participation, they should take action to get beneficiary contribution and it is further described the importance of assigning the responsibility of maintaining capital assests by the community organizations. When applying PPPs at provincial level projects, it is not necessary to enter into mega scale agreements as required at national level special projects. Since the projects to be implemented at provincial level are at middle or small scale, the investors should be selected accordingly. However, when entering into agreements with private sector, it is essential to maintain the transparency adherence to the accepted procurement procedures. The involvement of provincial level Chambers of Commers, provincial commercial and development banks and private companies should be ensured. It seems that for the provincial level projects, the provinces are heavily dependent on government funds. Although, the central government funds are to be utilized for the essential public services, the private sector participation could be obtained for the projects that could be carried out on commercial basis. Specially the PPP approach could be utilized for development of agriculture, dairy farming, industries, ayurveda and western medical centers,(hospitals not owned by the government ) In such a approach, the task to be performed by the provincial council and the private sector and their responsibilities need to be clearly identified and also enactment of new rules and regulations is also expected to be done wherever necessary. After setting up of a special consortium with participation of the institutions coming under provincial councils and the private sector that is willing to participate, a Special Purpose Vehicle (SPV) for the relevant purpose can be established. From the government side the land owned by the state can be given as part of the equity capital and financial allocations could also make available, if necessary. The private sector, in addition to providing financial contribution could get involved in project activities, project implementation and management. Both parties have to equally agree to share the risk factor, if any, and also the both parties should properly adhere to the basic principles such as social responsibility, minimizing the cost, proper management increasing the working capacity, and efficient service providing etc. In this type of integrated investment programs, the contribution of provincial councils should be limited for building of assets and it is more appropriate to assign the responsibility of running the venture by the private sector in a profitable manner. There is a provision to get contribution from NGO’s or community organizations as and when necessary. In addition to this process, the responsibility of running and managing an asset built on government fund could be assigned to a private investor. However, the main principle is that the government or the provincial body should not directly involve or intervene in such ventures. The main reason is that the capability and the knowledge in handling commercial ventures is minimal in the government institutions and such a service cannot be expected from the government officials. But the responsibility in regulating the tasks assigned to private sector lies with the government institutions including provincial councils. Despite the fact that the money is invested through government funds or the private funds, the government has the responsibility with regard to maintaining the required standards of the service and fair price for the service. In summary, investments to be done on PPP approach at provincial level could be carried out under the following four methods.

- After completion of infrastructure facilities by the government, assigning of management to private sector; Example: small power plants.

- Putting of state land as a part of equity capital and to give a share value for the same. Example: projects in tourism sector.

- Putting capital investment proportionately like 50:50 basis by the both parties on a selected venture and share the profit accordingly. Example; Dairy Farming.

- Leasing out government assets or lands for a specific period. Example; Industrial states.

- Summary

PPP is a different process and it is not a synonym to privatization. In this process the sale of state assets to private sector is not taken place. The idea of the PPP is to provide common services through private sector or implementation of infrastructure projects by state agencies in collaboration with private companies. In such partnerships, the public sector and the private sector enter into agreements and the private party has to bear financing and technological responsibilities and to bear up a risk in that respect. As a solution to resolve the financial constraints, the governments engage in such partnerships and especially this approach is mostly used for development of economic infrastructure. This approach is also used in the field of social infrastructure like health and education. The state enters into agreements in assigning such a service providing responsibility to the private sector. Depending on the status of the project, the price for the service is paid by the state or the beneficiary. In this approach, sometime state contributes for the main capital investment and it will be done by way of financing or in allocation of state land. In addition, in order to encourage the private investments, state provides capital subsidy, revenue subsidy, tax breaks etc. At the same time, the private sector has to bear the social responsibility paying attention on environmental management, adoption of local knowledge and ensuring political support. Supply of services as agreed by the private sector in a fair manner is the main role that expected from the private sector. However, the principle of social responsibility is connected to the private sector in this exercise. Among the task to be performed by the government in ensuring the successfulness of the PPPs, the creation of clear legal background, preparation of strategic plans within the government policy framework, declaration of investment opportunities and proper monitoring mechanism are vital importance. The countries like India, Pakistan and South Africa have taken institutional measures to promote PPP as an alternative financing mechanism. The USA is adopting this approach in social infrastructure sector with a view to providing an efficient service to the clients. As stated in the Government’s Medium-Term Policy Framework, PPP approach has been accepted as a government policy to be adopted at the national as well as at provincial level. Setting up of required legal and political background is the responsibility of the respective government agencies and provincial councils. The existing rules and regulations sometime become obstacles for this approach and as such necessary amendments is inevitable. The existing laws and regulations of each institution sometimes become hindrance in entering into agreements particularly, on alienation of lands. Therefore, it is necessary to resolve such issues at provincial level. In PPP based investments, beneficiary contribution could also be obtained specially in maintaining public assets. In the formulation of investment plans and preparation of projects, the government is expected to give priority for PPP approach at national and also at provincial level and it would be a fruitful solution for the funding problem and improving the service efficiency. Another essential factor to be considered is to make the political authority, government officials, private entrepreneurs and general public be convinced about the capital market and its stakeholders and its practical behavior. ————————————————————————————————————————————– References:

- How to engage with Private sector in public-Private Partnerships in emerging Market :-(World bank publication )

- Mahinda Chinthana Vision for Future. Development Policy Framework of the Government.

(Department of National Planning)

- The guidelines issued by the Finance Commission to the Provincial Councils.

- Annual Report of the Finance Commission for the year 2011.

- Identifying Public-Private Opportunities for Local Governments in Sir Lanka, Discussion Paper by The Asian Foundation, iDeCK and World Bank, February 2013.

- Public-Private Partnerships Policy and Private – A Reference Guide, Commonwealth Secretarial, 2010.

This author is a Senior officer falls into a special grade in the Sri Lanka Planning Service. He has obtained BA (Hons) degree in Economics from the University of Peradeniya. He also holds M.A. Degree in Regional Development Planning from the ISS in the Netherlands. Presently, he is working as a Director in the Finance Commission and before that he served as an Addl. Director General of the Department of National Planning. He has served as an external Resource Person in the Sri Lanka Institute of Development Administration. Note : The agency where the author is attached is not responsible for the views contained in this article.